In a Nutshell

Using the Consumer Price Index from the U.S. Bureau of Labor Statistics, consumers can calculate the inflation rate for goods and services. Identifying cost trends may help budgeting and savings goals.Inflation can be defined as the overall general upward price movement of goods and services in an economy. Learning how to calculate the inflation rate can help you understand how inflation impacts your everyday life, specifically your spending power.

Since consumer prices are expected to rise 2.3% in 2023, learning what to expect from future inflation trends may help you better manage your finances.

- What is the inflation rate?

- Types of inflation

- Inflation rate formula

- How to calculate inflation rate

- Inflation rate calculation examples

- What’s next

What is the inflation rate?

The inflation rate refers to the rate at which inflation increases over a specific period. This rate reflects the relationship between currency value and the cost of goods and services (or COGS).

Inflation is the concept that the prices of goods and services increase over time, reducing the value of a currency. While the Federal Reserve addresses this by hiking interest rates, many consumers still feel the impact of rising costs.

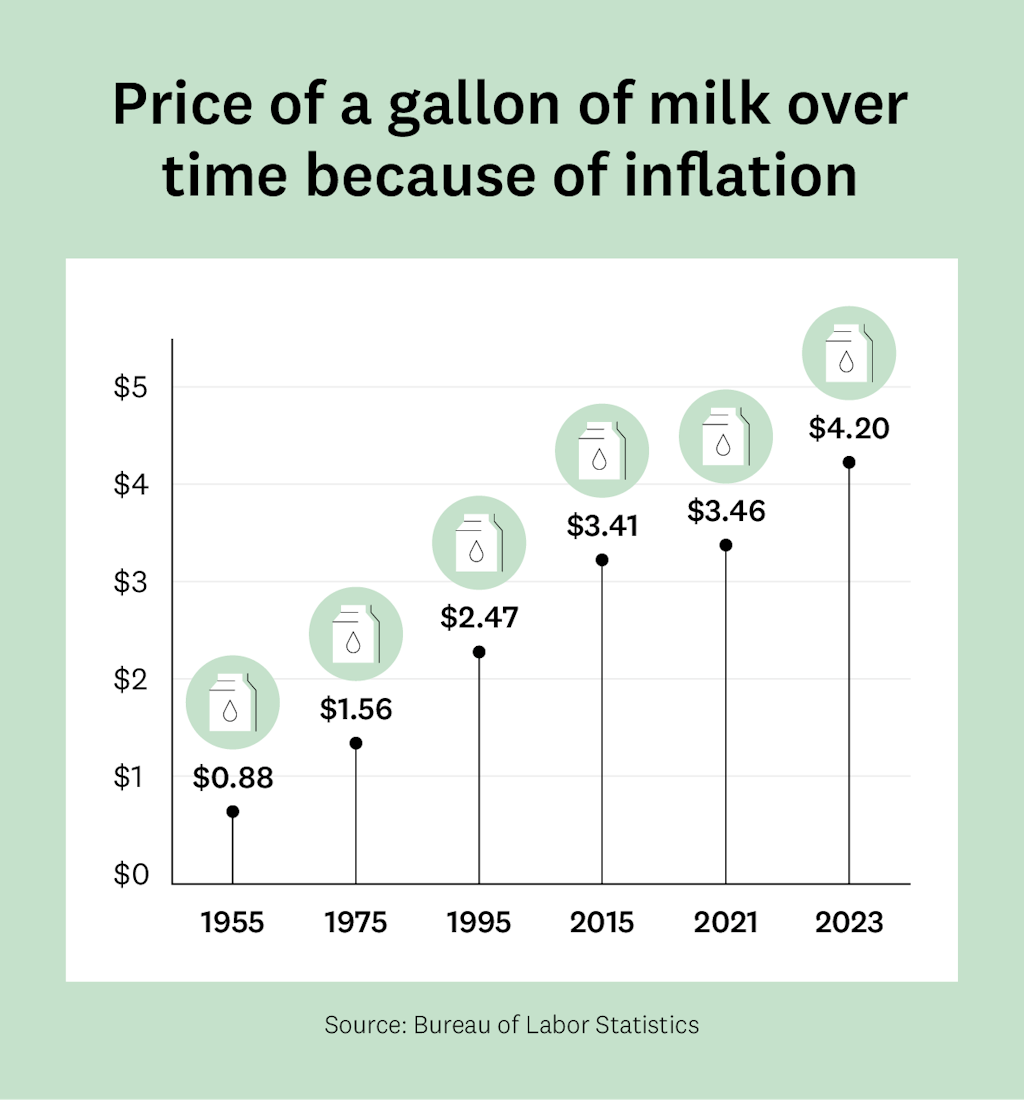

For example, let’s say you have $7 and want to buy a gallon of milk. If you bought it in January 2023, when it cost $4.20, you could only buy one gallon. In January 2021, with the same $7, you could have bought two gallons of milk for $3.47 each. Your purchasing power decreased because of inflation.

As a consumer, knowing the basics of inflation is important to understand how these cost-of-living fluctuations impact your finances over time.

Image: price-of-a-gallon-of-milk-over-time-because-of-inflation

Image: price-of-a-gallon-of-milk-over-time-because-of-inflationTypes of inflation

Demand-pull inflation

Demand-pull inflation can occur when there’s a higher demand for services and goods than the economy can produce.

Example: Consumers want to buy milk, but farmers don’t have enough supply, so the price of milk goes up.

Cost-push inflation

Cost-push inflation happens when it becomes more expensive to produce goods and services, causing the prices for those goods and services also to increase.

Example: The tools and/or materials necessary to produce milk increased in price, causing the milk price to increase as well.

Built-in inflation

Built-in inflation happens when workers request higher wages to keep up with living costs as the prices of goods and services increase. Many businesses may increase their employees’ salaries to appease workers and avoid a labor shortage.

These businesses typically pay themselves back by charging customers more, contributing to rising prices of goods and services.

Example: Farmhands request higher pay to keep up with inflation, so the farmer increases the milk prices to compensate.

Inflation rate formula

To calculate the inflation rate you’ll need a start date, an end date and data from the Consumer Price Index, which measures average change in price over time and is issued by the U.S. Bureau of Labor Statistics.

To do this, you can use the inflation rate formula. This formula allows you to see the percentage of increase or decrease in cost between years.

Inflation Rate = ((B-A)/A) x 100

In the formula, A would be the starting cost in the Consumer Price Index for a specific good or service in a specific year or month and B would be the ending cost for the same good or service.

To use the formula:

- Subtract A from B to determine how much the price of that specific good or service has changed.

- Next, divide the result by A (the starting price to get a decimal number.

- Convert the decimal number into a percentage by multiplying it by 100. The result is the rate of inflation.

How to calculate inflation rate

Here are the steps you can use to find the inflation rate:

Step 1: Decide what you want to calculate

Decide which good or service you want to analyze, as well as the period. You can gather average consumer price data from Consumer Price Index.

How to do it: Let’s say you want to calculate the inflation rate of a gallon of milk from December 1995 to January 2023. If you go to the CPI average data for the price of fresh whole milk nationwide, you will see the average price for a gallon of milk was $2.55 in January 1996, and $4.20 in January 2023.

Step 2: Label the price points

Label the price for the beginning date as A since that is the starting number in your formula. Next, label the second price as B since that is the ending number.

| January 1996 | January 2023 |

|---|---|

| $2.55 = A | $4.20 = B |

Step 3: Plug it in the inflation formula

The last step is to plug the information into the inflation formula and do the calculations. You will subtract the starting price (A) from the ending price (B) and divide it by the starting price (A). Then multiply the result by 100 to get the inflation rate percentage.

Inflation Rate = ((B – A) / A) x 100

Inflation Rate = ((4.20 – 2.55) / 2.55) x 100

Inflation Rate = (1.65) / 2.55) x 100

Inflation Rate = (0.647) x 100

Inflation Rate = 64.7%

Inflation rate calculation examples

Here are a few more examples of how to calculate the inflation rate:

Example 1

You want to find the inflation rate for bananas between July 2001 and March 2014. If the average price of a pound of bananas nationwide was $0.52 in July 2001 and $0.59 in March 2014, the calculations would be as follows:

Start date: July 2001. Price: $0.52 = A

End date: March 2014. Price: $0.60 = B

Inflation Rate = ((B – A) / A) x 100

Inflation Rate = ((0.60 – 0.52) / 0.52) x 100

Inflation Rate = (0.08) / 0.52) x 100

Inflation Rate = (0.1538) x 100

Inflation Rate = 15.38%

Example 2

Now let’s find the inflation rate for unleaded gasoline between January 2002 and July 2021. The average price of unleaded gasoline nationwide was $1.14 per gallon in January 2002 and $3.23 in July 2021.

To find the inflation rate, you would first subtract $1.14 (A) from $3.23 (B), which is 2.09 and divide that by 1.14 (A), resulting in 1.83.

To get the percentage, multiply it by 100, and the inflation rate for gasoline in July 2021 compared to January 2002 is 183%.

Start date: January 2002. Price: $1.14 = A

End date: July 2021. Price: $3.23 = B

Inflation Rate = ((B – A) / A) x 100

Inflation Rate = ((3.23 – 1.14) / 1.14) x 100

Inflation Rate = (2.09) / 1.14) x 100

Inflation Rate = (1.83) x 100

Inflation Rate = 183%

What’s next

The inflation rate can’t help you predict future costs, but it can help you understand how the costs of goods change. As a consumer, being aware of the inflation rate and how it impacts your daily and monthly expenditures can help you budget and save accordingly.